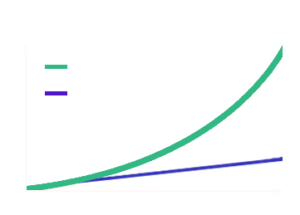

What is AutoStake?

When you stake with BTCS and enable AutoStake for any or the coins below, your rewards automatically reinvest twice a day back into the network at no cost to you, so you can compound your rewards.

Ready to Enable AutoStake?

Select any of the AutoStake supported networks below and follow simple five step process.

|

-

Step 2

Connect Keplr

WalletClick below to connect your Keplr wallet to BTCS.

-

Step 3

Delegate to BTCS

Click below to delegate your Cosmos to BTCS validator.

-

Step 4

Redelegate to BTCS

Click below to redelegate your Cosmos to BTCS validator.

-

Step 5

Enable

AutoStakeYOU DID IT! Simply click below and start compounding your rewards.

|

-

Step 2

Connect Keplr

WalletClick below to connect your Keplr wallet to BTCS.

-

Step 3

Delegate to BTCS

Click below to delegate your Kava to BTCS validator.

-

Step 4

Redelegate to BTCS

Click below to redelegate your Kava to BTCS validator.

-

Step 5

Enable

AutoStakeYOU DID IT! Simply click below and start compounding your rewards.

|

-

Step 2

Connect Keplr

WalletClick below to connect your Keplr wallet to BTCS.

-

Step 3

Delegate to BTCS

Click below to delegate your Akash to BTCS validator.

-

Step 4

Redelegate to BTCS

Click below to redelegate your Akash to BTCS validator.

-

Step 5

Enable

AutoStakeYOU DID IT! Simply click below and start compounding your rewards.

|

-

Step 2

Connect Keplr

WalletClick below to connect your Keplr wallet to BTCS.

-

Step 3

Delegate to BTCS

Click below to delegate your Cosmos to BTCS validator.

-

Step 4

Redelegate to BTCS

Click below to redelegate your Cosmos to BTCS validator.

-

Step 5

Enable

AutoStakeYOU DID IT! Simply click below and start compounding your rewards.