Learn More About Polygon

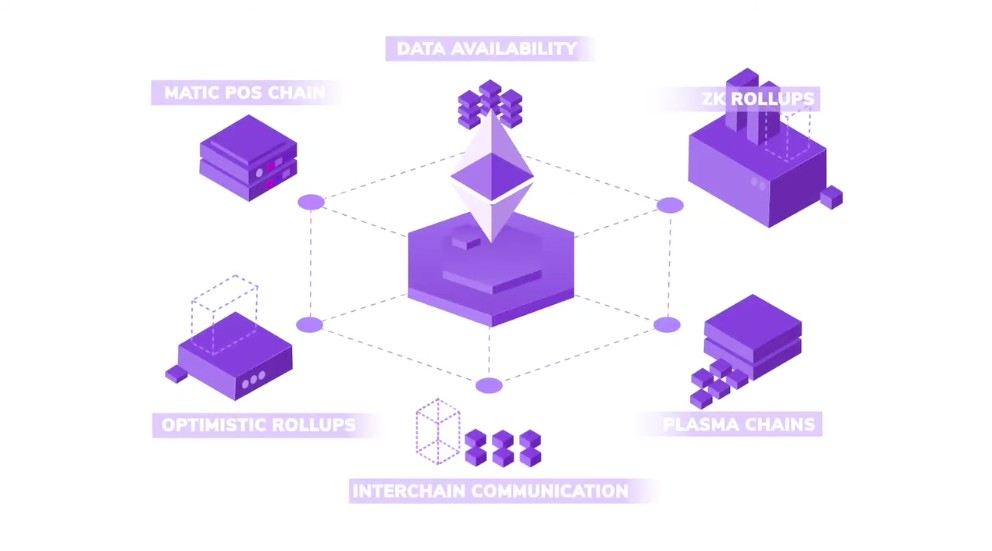

What is Polygon (MATIC), and what is it used for?

MATIC is used to pay transaction fees, distribute staking rewards, and make governance decisions on Polygon’s Proof-of-Stake blockchain. Polygon’s main focus is to build highly scalable and interoperable solutions that are Ethereum-compatible.

What are Polygon staking rewards?

Staking rewards in the form of native blockchain tokens (MATIC) are distributed to validators for locking up their cryptocurrencies to a blockchain network to support validator node’s participation in the consensus mechanism and securing the network for a period of time. Refer to the data above for the latest Polygon staking reward figures.

What are the current use cases of Polygon?

Polygon’s robust range of use cases includes powering the Web 3.0 arm of some of the world’s largest tech and consumer companies, including Reddit, Starbucks, and Coca-Cola.